do you pay taxes on inheritance in north carolina

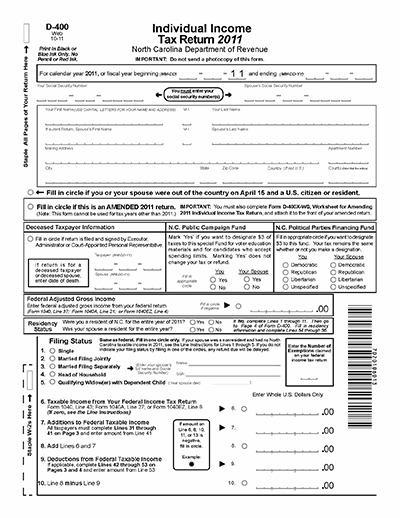

Does North Carolina have an estate tax or inheritance tax. However there are sometimes taxes for other reasons.

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received.

. If you inherit property in Kentucky for example that states inheritance tax will apply even if you live in a different state. If you inherit property. The estate may be liable for federal estate taxNorth Carolina currently has no inheritance taxif the amount of the inheritance is above the estate tax threshold.

The inheritance tax of another state may come into play for those living in North Carolina who inherit money. If the estate exceeds the federal estate exemption limit of 1206 million it becomes a subject for the federal estate tax with a progressive rate of up to 40. We have offices located across western North Carolina and upstate.

There is no inheritance tax in NC. Its paid by the estate and not the heirs although it could reduce the value of their inheritance. The threshold for decedents.

These include Capital Gains income tax from retirement accounts and other like taxes. However there are sometimes taxes for other reasons. Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within the state.

There is no inheritance tax in North Carolina. Do you have to pay inheritance tax in North Carolina. Currently states that have an inheritance tax include Iowa Kentucky Nebraska New Jersey Maryland and Pennsylvania.

However if you inherit an estate worth over 1118 million in standard assets such as bank accounts you may be required to pay taxes federal estate tax. If you live in a state that does have an estate tax you may be expected to pay the death tax on the money you inherit from a death in NC. North Carolina does not collect an inheritance tax or an estate tax.

Currently the estate tax threshold is 1118 million for an individual and double that for a couple. These are some of the taxes you may have to think about as an heir. Estate taxes are imposed on the total value of the estate - if the total estate value is large enough - the executor executor of the estate must file federal and a North Carolina estate tax returns and pay any tax due within 9 months after the death.

In North Carolina you are not required to pay state estate tax or inheritance tax. However there are sometimes taxes for other reasons. North carolina does not have estate or inheritance taxes.

There is no inheritance tax in North Carolina. Fortunately if you live in North Carolina you dont have a state-level estate tax or inheritance tax to worry about. There is no inheritance tax in NC.

2 An estate tax is a tax on the value of the decedents property. However - there is no inheritance taxes on neither federal nor state level in North Carolina. The inheritance tax of another state may come into play for those living in North Carolina who inherit money.

According to the new 10-year payout rule inherited IRAs that distribute large amounts of income each year may require heirs to pay. The amount of money you will pay tax on is determined by the difference. No estate tax or inheritance tax North carolina does not collect an inheritance tax or an estate tax.

North Carolina does not collect an inheritance tax or an estate tax. Despite the inheritance tax repeal which gives north carolina residents the benefit of the full applicable credit amount for transfers at death north carolina has not fully unified its estate and gift tax system. No Inheritance Tax in NC.

The state of North Carolina requires you to pay taxes if you are a resident or nonresident that receives income from a California source. Certain assets such as retirement accounts and life insurance policies may be subject to additional taxes. The recipient of an inheritance is not going to be paying transfer taxes on the inheritance unless there is an inheritance tax in the state within which the recipient resides.

There is no inheritance tax in NC so if you give 18000 to your niece at your death you dont need to worry about your estate or her paying taxes on it. North Carolina does not collect an inheritance tax or an estate tax. You may not have an.

However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1206 million. An inheritance tax is a tax on the property you receive from the decedent. These tax issues vary a great deal based on state law and unique circumstances so if you have a tax issue or other legal issue contact King Law at 888-748- 5464 KING for a consultation.

While 2010 has an unlimited. North Carolina does not collect an inheritance tax or an estate tax. However there are 2 important exceptions to this rule.

However state residents should remember to take into account the federal estate tax if. No Inheritance Tax in NC.

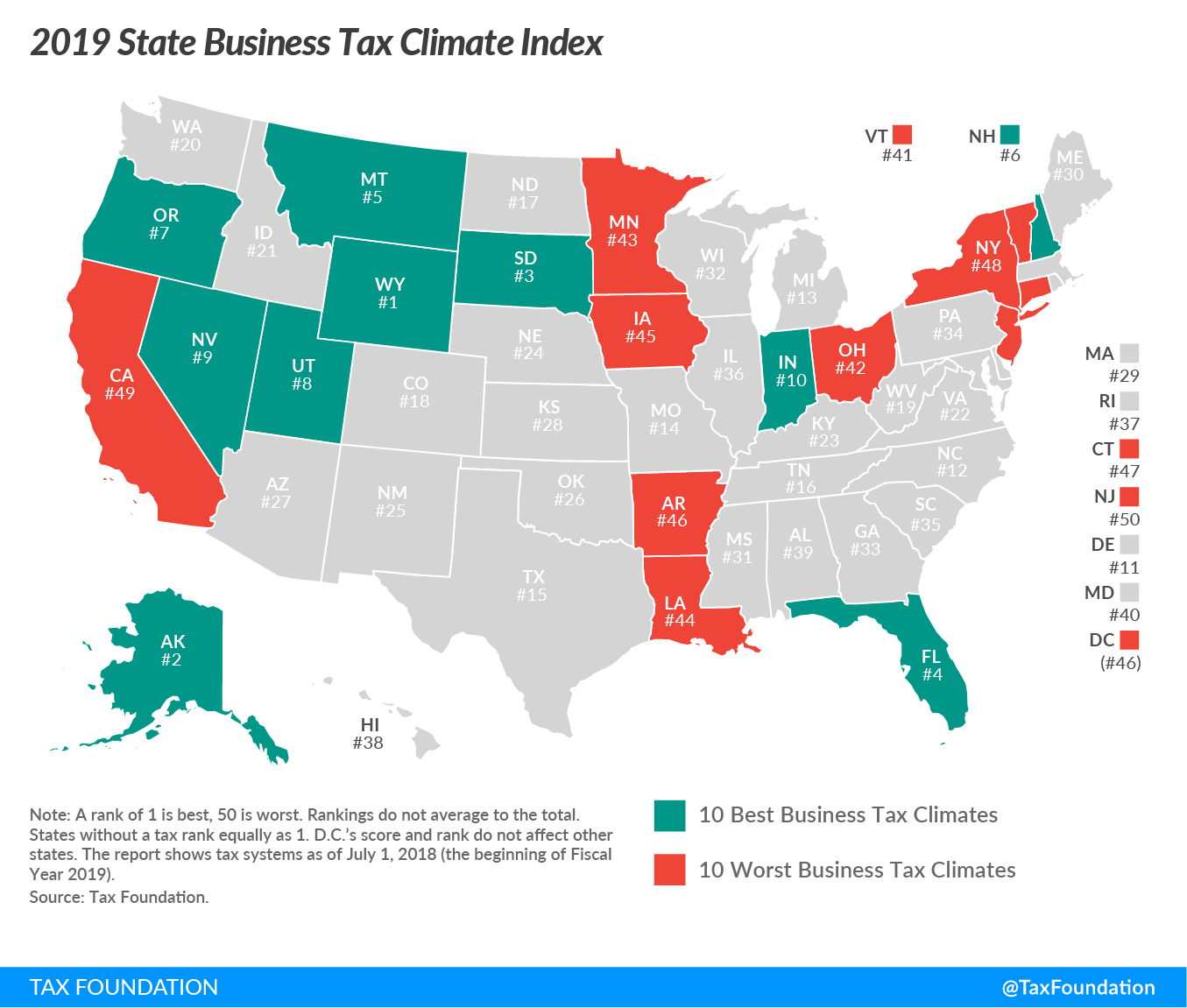

North Carolina Ranks Third Nationwide In Competitive Corporate Income Taxes Economic Development Partnership Of North Carolina

North Carolina State Taxes Everything You Need To Know Gobankingrates

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

Historical North Carolina Tax Policy Information Ballotpedia

North Carolina Teaching Resources Teachers Pay Teachers

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

North Carolina Health Legal And End Of Life Resources Everplans

How Can I Mitigate My Children Paying Taxes On My Estate In Raleigh When I M Gone

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

North Carolina State Taxes 2022 Tax Season Forbes Advisor

North Carolina Last Will And Testament Template Download Printable Pdf Templateroller

How To Inherit Retirement Assets In North Carolina

North Carolina Ranks Third Nationwide In Competitive Corporate Income Taxes Economic Development Partnership Of North Carolina

Tax Concerns For North Carolina Inheritances North Carolina Estate Planning Blog

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

187 Front Page 1 30 Normalize North Carolina Court System

North Carolina Retirement Tax Friendliness Smartasset

John Spencer Bassett 1867 1928 Slavery In The State Of North Carolina