costa rica taxes for canadian expats

No wonder so many expats opt for. The capital gains charge is 15 for residential properties and 30 for commercial properties.

Residency Applications Embassy Of Costa Rica In Canada

This amount is calculated off the sales profit made over your original purchase price.

. Is reporting that 900000 copies of Canadian expats citizens bank records have been shared with the US. An international airport great shopping and entertainment and hospitals and clinics. One budget friendly item many love about Costa Rica is the tax advantages it offers.

All amounts are given in CRC Costa Rica Income Tax Rates for Residents Non-residents salaries or self-employment income is taxed at a flat rate of 10 15 or 25 depending on the type of income they receive. As regards the application of this Agreement at any time by a Party any term not defined therein shall unless the context otherwise requires or the competent authorities agree to a common meaning pursuant to Article 11 have the meaning that it has at that time under the law of that Party any meaning under the applicable tax laws of that Party prevailing over a meaning. However you will be required to pay income tax on any Costa Rican income resulting from your local investments per Law 7092 Spanish the Income Tax Law.

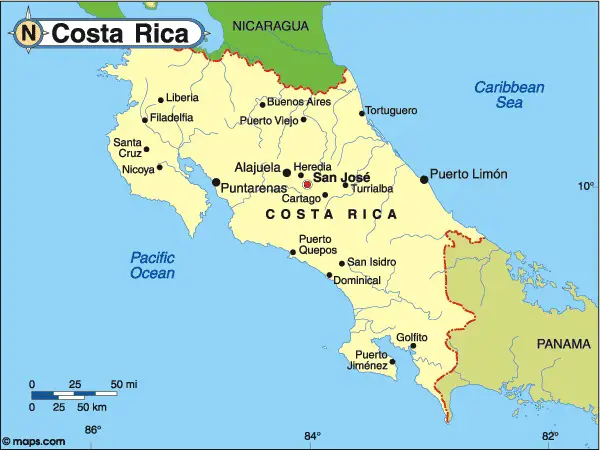

At the same time you will pay up to 25 tax as a business. The average price of living in Costa Rica is approximately 3 000 CAD for a family of four and around 845 CAD for a single person living in San José per month without rent. Costa Rica has a lot to offer expats with its tropical climate eco-friendly culture beautiful beaches welcoming people good healthcare system.

The region is centred around the capital of the country San Jose and has all the facilities at hand. Investors do not pay capital gains on real estate high-interest bank accounts are tax free and business taxes are low. Attend our monthly events and activities for Canadians expatriates to get to know like-minded expatriates in real life.

A declaration must be filed in the San Jose location. The maximum tax rate of 15 percent for employment income and 25 for self-employment and business income. As a non resident - you can either pay the 25 flat withholding tax or file taxes if you think your obligation will be less than 25.

Costa Rica Income Tax for Wages Fixed Salary Taxable Monthly Income. Income subject to tax in this country includes employment income self-employment business income investment income directors fees and capital gains. The maximum tax rate of 15 percent for employment income and 25 for self-employment and business income.

As a resident abroad - youd have to file taxes but if your retirement income is relatively low - youll likely be less than the 25. However if youre a non-tax resident your income tax rate will fixed at either 10 percent 15 percent or 25 percent depending on the income type and is withheld by your employer. The Central Valley is a favourite Costa Rican destination for expats.

Our team of US tax professionals has decades of tax preparation experience helping expats just like you and our streamlined process means our fees are among the lowest in the industry. Costa Rica is less expensive than Canada but its not the cheapest country in Latin America. Income Earned Tax Rate.

The annual property tax in Costa Rica is assessed at a fixed rate of 025 of the propertys value per year. Similar to how you settled taxes with the IRS prior to moving to Costa Rica you will need to settle tax issues with Costa Ricas Ministry of Finance. The Central Valley.

For individuals domiciled in Costa Rica any income obtained within the boundaries of Costa Rica is considered as Costa Rican-source income and is taxable. Last reviewed - 03 February 2022. Income taxes on individuals in Costa Rica are levied on local income irrespective of nationality and resident status.

The Complete Guide to Costa Rica Retirement Visa. What You Need to Know in 2022. Does Costa Rica have income tax.

The towns that are most inhabited by expats are Atenas Dominical Escazu Grecia Jaco Puerto Viejo and Tamarindo. USTaxGlobal provides Simple Secure Affordable tax preparation services to US expats all around the globe. In Costa Rica income tax rates are progressive.

The good news is taxes are generally low in Costa Rica if you are employed. Earned Income Tax Rate. Between 714000 and 1071000 10.

Income taxes for tax residents in Costa Rica are set at a progressive rate which range from 0 percent to 25 percent. Costa Rica income tax rates are progressive between 0-25. Health Insurance for Expats in Costa Rica.

There are 2 different types of income taxes in Costa Rica. Those who love the. Learn More Connect with USTG.

Up to 714000 Exempt. Canadian pundits expect expat exodus from Hong Kong. You will pay a maximum of 15 tax for your wage as an employed person.

The tax rates for self-employed workers for tax year 2013 are slightly different. Meet other Canadians at our events in Costa Rica. Income tax on wages and income tax on profit generating activities.

Costa Rica didnt have a capital gains tax except for developers until 2019. The Costa Rican sales tax is referred to as VAT and is currently 13 percent. Meet Jason Canadian Expat in Costa Rica.

InterNations San José Event Let the Night Be Filled with. Up To 3171000 Exempt. Real Estate Tax Breaks Beneficiaries of this law will also be granted a 20 exemption on total property transfer taxes for real estate acquired during the term of this law.

Cost of living in Costa Rica. The taxation rate for salaried employees in Costa Rica for a tax year 2013 is as follows. When property is purchased in Costa Rica it must be transferred into the buyers name.

Above 1071000 15.

2021 Us Foreign Earned Income Exclusion The Ultimate Guide

Costa Rica Eldercare And Assisted Living For Expats

Living Abroad Guides And Resources Frayed Passport

Do I Need To File State Taxes If I Live Abroad

/CIA_map_of_the_Caribbean-822e94431d4647ba9ca350ebf28eb23b.png)

Top 10 Offshore Tax Havens In The Caribbean

Expat Exchange Best Places To Live Overseas Costa Rica Vs Panama

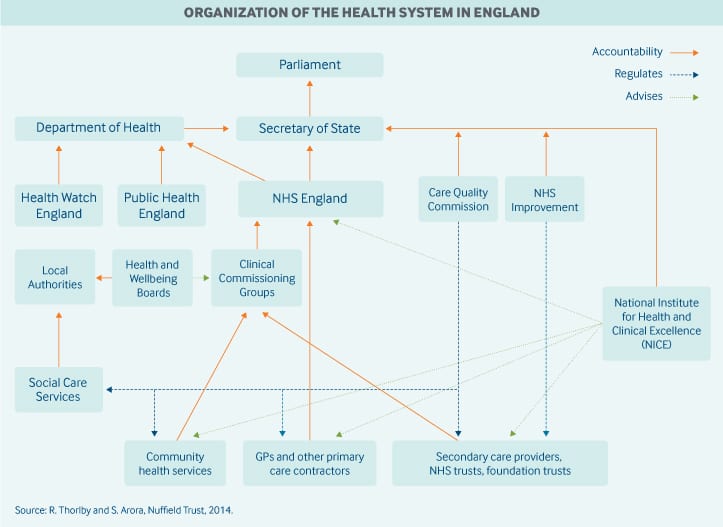

Uk Healthcare System What Foreigners Need To Know

How Much Do Things Really Cost In Costa Rica

2021 Us Foreign Earned Income Exclusion The Ultimate Guide

Should I Move To Portugal Or Canada Quora

25 Tax Resources Every Expat English Teacher Should Know About Profs Abroad

Do I Need To File State Taxes If I Live Abroad

Everything You Need To Know About Expat Taxes In Canada

2021 Us Foreign Earned Income Exclusion The Ultimate Guide

Expat Cost Of Living In Costa Rica Adam Fayed

How Much Do Things Really Cost In Costa Rica

Expat Cost Of Living In Costa Rica Adam Fayed

Do I Need To File State Taxes If I Live Abroad

Moving To Canada Just How Good Is Life For Expats Canadianvisa Org